Slotozilla houses a catalogue of best-in-class demo slot games spanning several key genres. Each game category is catered to different player preferences – all with the goal of providing top-tier action to a global casino audience.

In this iGaming data breakdown, we unveil Slotozilla Demo Slot Statistics in 2024 pertaining to demo slots. This includes playtime, demographic breakdowns, popular titles, and much more. All figures discussed here are based on internal findings uncovered using modern technology developed by renowned website data aggregators.

Popular Slotozilla Demo Slots

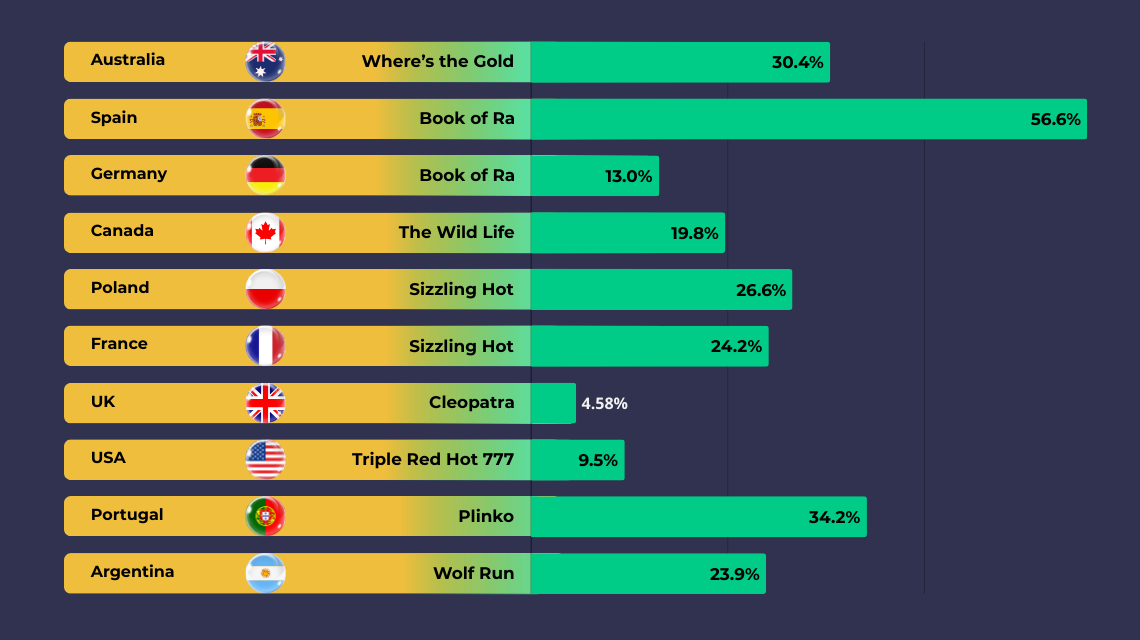

Gaming preferences vary from region to region, with certain titles gaining more traction than others in select territories.

“Where’s the Gold” earned 30.42% of demo playtime by users in AU, while “Book of Ra” accumulated 56.55% of playthroughs in ES and 13.04% in DE.

In CA, Slotozilla demo players spent the most time on “The Wild Life”. Novomatic’s “Sizzling Hot” took the throne among PL players, accompanied by “Sizzling Hot Deluxe” in FR. The UK saw a surprise game attract more attention than all others – as “Cleopatra” drew attention from the most users.

“Triple Red Hot 777” took the majority of in-game time for users in the USA. On the flip side, just 3.92% of US demo time was spent on “Double Diamond.” The former boasts almost double the playtime compared to the latter.

PT demo players viewed “Plinko” as the most enticing offering, averaging 34.15% of all game time spent. That slot is followed by “Gold Digger” at over 17%, while “Wolf Run” accumulated 23.9% of time committed to Slotozilla demo slots in AR.

This analysis evidences that Spain holds a stronger affinity for the Book of Ra than any other region for any alternative title. Moreover, the Book of Ra stands as the only slot to be most popular in two separate territories.

See the list below for a breakdown of demo playtime per region.

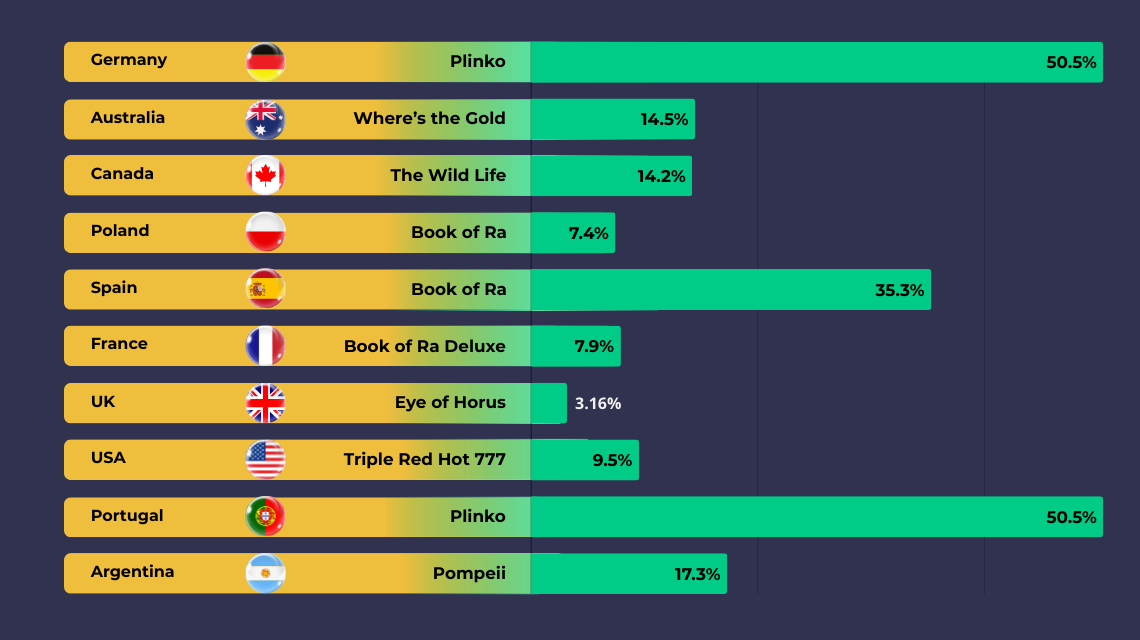

New Player Favourite Games

As evidenced by the data in our findings, new players tend to favour certain online slots. According to our research, “Plinko” represents the strongest slot in terms of sheer numbers among new Portuguese users—with 50.47% of newcomers indulging in the game.

Our data also reveals that “Book of Ra” and “Razor Shark” contribute a significant portion of the time spent on demos by brand-new users located in Germany, while ‘Pompeii’ is favoured by Argentine bettors.

Slots such as “Sweet Bonanza” and “Fishin’ Frenzy” underperformed in this regard. While most predictive metrics should suggest that new users would move towards these industry favourites, the candy-focused title earned just 2.84% of playtime in CA, and the fishing-centric release held only 2.12% in the UK.

Conclusions indicate that new players are decidedly unpredictable when it comes to time spent on traditionally popular titles. However, simple games — like Plinko — hold a strong player base. The Book of Ra series also attracts notable attention from new users.

New player favourites:

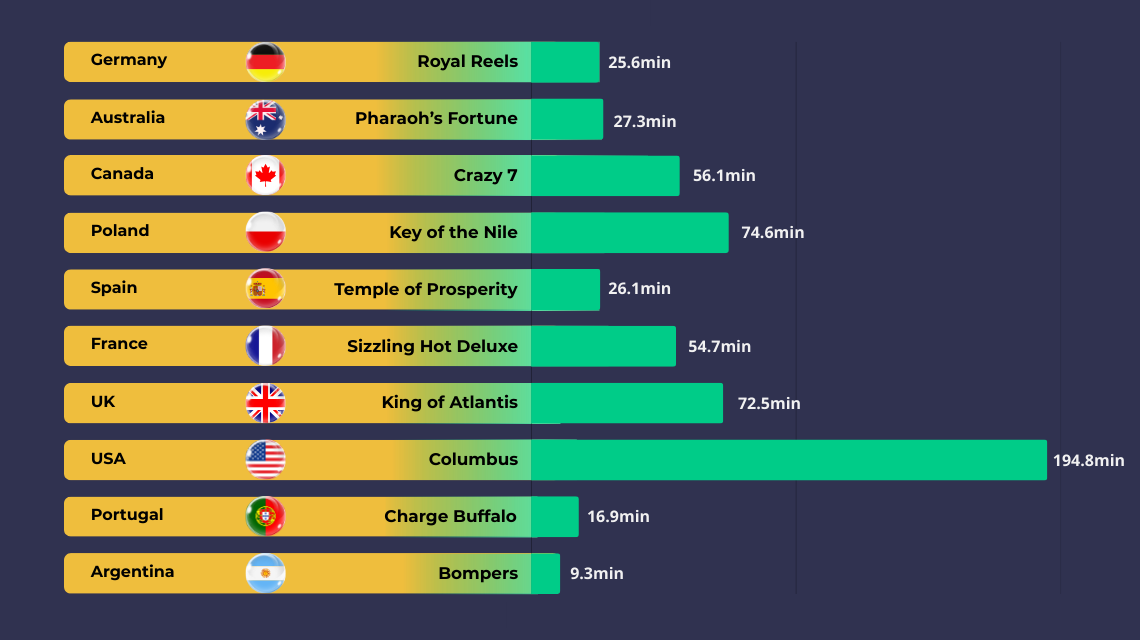

Popular Slots by Average Playtime

Average playtime often better represents the true view of an iGaming audience than hard-and-fast player counts. The more impressive the figures attached to in-game time, the greater the proposed experience. Titles that first attract and then shed players quickly forbode poor performance.

For example, “Columbus” has proven a hit among the US audience – garnering an average playtime of 194.8 minutes. History plays a key role in this game’s popularity within North America, and engagement based on domestic pride, historical occurrences, nostalgia, and immersive themes serve as crucial reasons behind solid playtime figures.

In the DE market, the most impressive average playtime figure is tied to “Royal Reels”, at 25.6 minutes per session. The AU player base spent a similar amount of time on its favorite demo — Pharaoh’s Fortune — with 27.3 minutes.

CA gamblers demonstrated a clear preference for “Crazy 7” at almost one hour per gambling session. As for PL users – customers in this territory donated over 74 minutes to “Key of the Nile”, earmarking this online slot machine as a hot prospect in that region. Players in the ES market opted for “Temple of Prosperity” above any other game, while nearby FR punters chose ‘Sizzling Hot Deluxe’ more than half the time.

“King of Atlantis” gathered more playtime than all competing UK slot machines at an average of 72.5 minutes. PT and AR players dedicated noticeably fewer minutes to their beloved slots – averaging 16.9 minutes to “Charge Buffalo” and 9.3 minutes to “Bompers”, respectively.

See the top slots by average minutes of playtime per country here:

Our research points to players in France, the UK, the USA, Poland, and Canada as affording the most time to their favourite slots, whereas Argentine and Portuguese users tend to spend less time on both nations’ most-played titles.

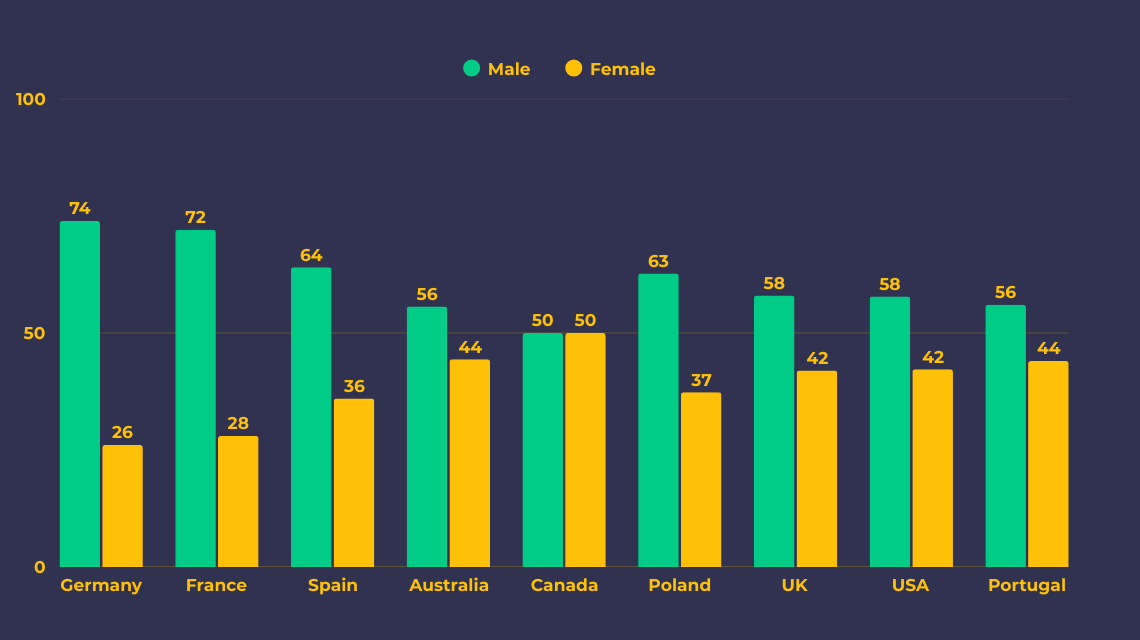

Player Data by Gender

Gender plays an influential role in the iGaming industry. Software developers and casino operators must cater to the audiences whom they predominantly serve – so understanding crucial nuances between male and female users is majorly beneficial.

For instance, DE demo slot players form 73.91% of Slotozilla’s users for that region. Similarly, high figures are present among FR gamblers (72%), with all other territories operating on a more evenly-matched scale.

62.68% of PL users are male, which is near the numbers published in ES data at 64.02%. When evaluating AR, however, we discovered that 49% of visitors who actively participate in casino games are female. At 44% for PT, 49.78% for CA, and 42% in the UK, we can see that certain regions cater to female users more than others.

This data demonstrates that although the industry remains male-dominant in many regions, the number of female users has begun to quickly expand in select areas. Canada and Argentina are most prominent in this regard – almost splitting the divide clean in half.

Countries with the Most Male Players:

- DE – 73.91%

- FR – 72%

- ES – 64.02%

Countries with the Most Female Players:

- CA – 49.78%

- AR – 49%

- AU – 44.38%

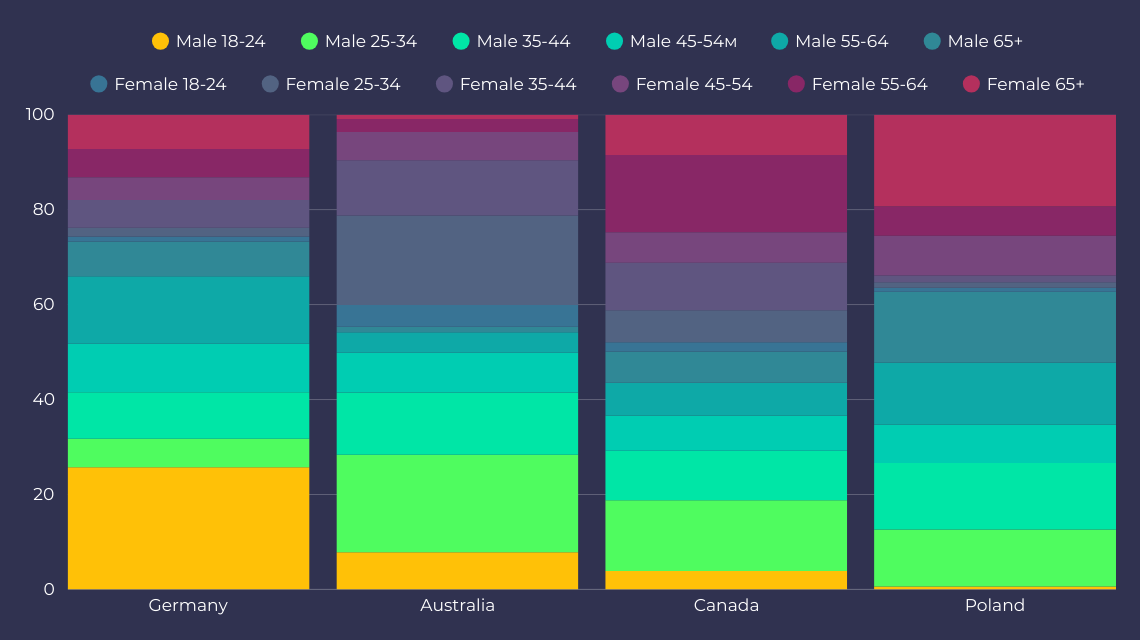

How Age & Gender Impact Preferences

Age and gender serve as two vital indicators of what particular groups want to see in the future and prefer to play now. Moreover, data of this ilk provides invaluable insight into the most prevalent player types on our platform.

Starting with the most remarkable outcome, the vast majority of DE players are males aged 18-24 (25.71%). Australian punters tend to be slightly older than their German counterparts — with 20.53% of users being 25-34 males and 18.86% being females — but there is a steep drop-off among AU’s 65+ age group.

Fascinatingly, Poland’s players typically sit in the 65+ range. This applies to male (14.88%) and female (19.28%) users who partake in Slotozilla demo games far more than 18-24 year-old males (0.64%) and females (0.87%).

Older female CA players also construct a wide piece of the nation’s demo game customers. 16.26% of slots gamblers are aged 55-64 in Canada, compared to 6.91% in the male category for the same age group. On the other end of the spectrum, females form just 1.92% of the 18-24 CA user base.

| Country | Most Prominent Gender & Age | Percentage |

|---|---|---|

| Germany | Male (18-24) | 25.71% |

| Australia | Male (25-34) | 20.53% |

| Canada | Female (55-64) | 16.26% |

| Poland | Female (65+) | 19.28% |

Where males engage in greater playtime, the average age tends to sit on the younger end of the scale. The opposite is true for regions where female gaming is most prominent – as outlined by statistics gathered in Canada and Poland.

Key Stats Roundup

Free demo slots produce adrenaline-fuelled action for players of all ages and genders. Although certain regions sway in one direction over another — such as the strong male player base in DE or free games being more popular among older Polish citizens — these games remain open to all.

When all data is accumulated and analyzed, it becomes clear that the online slot machine industry is decidedly male-dominated. Female users continue to join the fray, as is seen in AU, CA, AR, USA, and the UK, but there remain more male users across each nation.

It’s also worth noting that those in early adulthood (25-34) from Poland, Canada, and Australia access Slotozilla’s free gaming options more than users in the 18-24 range.

Short Intro

Data may appear convoluted and difficult to understand for users simply sifting through key reports. That’s why Slotozilla is committed to distributing crucial metrics in easily readable formats – with tables and bar charts being two go-to options.

Table Explanation

Table-based data breakdowns provide quick access to all information on this page, including popular slots, player preferences, average playtime, and gender distribution.

Check out the table below for a close look at the percentage of player types using our platform’s most popular and new titles, average time-based playtime, and the overall split between male and female users.

| Country | Top Demo Slot (Overall) | % (Overall) | Top Demo Slot (New) | % (New) | Longest Avg. Playtime Slot | Avg. Time (min) | Male (%) | Female (%) |

|---|---|---|---|---|---|---|---|---|

| DE | Book of Ra | 13.04% | Razor Shark | 18.22% | Royal Reels | 25.6 | 73.91% | 26.09% |

| AU | Where’s the Gold | 30.42% | Where’s the Gold | 14.47% | Pharaoh’s Fortune | 27.3 | 55.62% | 44.38% |

| CA | The Wild Life | 19.75% | The Wild Life | 14.21% | Crazy 7 | 56.1 | 50.22% | 49.78% |

| ES | Book of Ra | 56.55% | Book of Ra | 35.32% | Temple of Prosperity | 26.1 | 64.02% | 35.98% |

Slotozilla Games in 2024 – Final Analysis

Based on all the data accumulated by our team, it is clear that specific nations require particular approaches to marketing and publishing demo games. Online slot machines continue to be a young person’s pastime, but older generations also play a major role in pushing the industry further.

Operators should consider granting tailor-made bonuses to users where a particular slot is most popular. Moreover, iGaming organizations must look to female gamblers as key players in the current industry, with female-oriented promotions most appropriate in AU, CA, AR, UK, and PT. Above all else, it is recommended that software providers create rewarding experiences for a global player base—be they male or female.

This article presents aggregated data collected using analytics tools such as Microsoft Clarity and Google Analytics 4 to better understand user behavior on our website. All data is anonymous and aggregated, which means it does not contain personal information and does not identify individual users. We use this data to analyze trends, optimize user experience, and improve the site’s content.

Please note that we use cookies to collect this data. By visiting our website, you consent to the use of cookies as set out in our Cookies Policy.

All statistics and conclusions in the article are estimates and may not fully reflect the behavior of each user.

If you have questions about our use of data or would like to learn more about our analytics practices, please see our Privacy Policy section.